800-968-8900

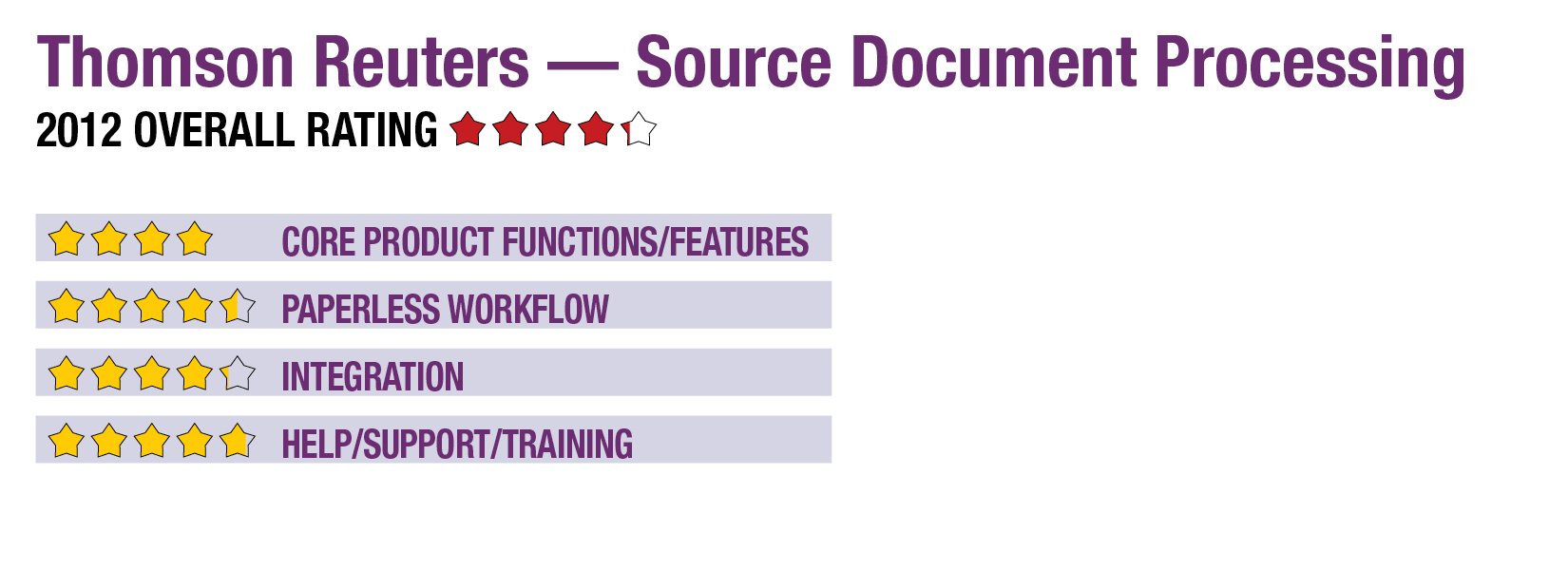

2012 Overall Rating 4.25

Best Firm Fit

Firms using other applications of the CS Professional Suite. Specifically, a FileCabinet CS license is required for the labeling and organizing function. An UltraTax CS license is required for the data extraction and import into the tax software.

Strengths

- Integration throughout the CS Professional Suite.

- At $6 per client, this is the least expensive software performing all of the scan, organize and populate functions included in this review.

Potential Limitations

- Requires firms to use FileCabinet CS for annotating and referencing source documents instead of Adobe Acrobat (though files can be exported in standard PDF format).

- Source Document Processing only accepts image files. If clients send their source documents that they have scanned themselves in PDF format, the practitioner will have to go through additional steps to convert them to a format that will be accepted.

- Besides the CS Professional Suite, Source Document Processing service does not integrate with any other third-party document management or tax software.

Summary & Pricing

The CS Professional Suite from Thomson Reuters offers an integrated set of tax, accounting and practice management applications. The Source Document Processing service integrates with both FileCabinet CS, the document management component of the suite, and with its tax application, UltraTax CS. This service will shortly be entering its fourth year of enabling users of the CS Professional Suite to have their clients’ source documents automatically and neatly labeled and organized, as well as transferring the captured data for individual income tax returns into UltraTax CS.

At $6 per client for an unlimited number of source documents, the UltraTax CS Source Document Processing Service is one of the least expensive among populate products. Since the price is per client, a firm can upload a stack of documents that is initially received and then later upload a late-arriving document such as a K-1 for no extra charge. Some firms elect to use the service for more complicated tax returns (for example, those with dozens of 1099s) but not for simple 1040s with only a couple of tax documents. The price includes labeling and organizing, as well as the option to integrate extracted data seamlessly into UltraTax CS.

Core Product Functions/Features 4

Paperless Workflow 4.5

Integration 4.25

Help/Support/Training 4.75

Thanks for reading CPA Practice Advisor!

Subscribe Already registered? Log In

Need more information? Read the FAQs